Lauren Garrett posted to Facebook a long piece on Feb. 18 about “honest budgeting” and the necessity to have that in municipalities. But what made her write it?

Garret, a mother, wife and former councilwoman of Hamden, wants her fellow citizens to be informed about how their town’s budget operates.

“I need people to understand that the consequences of not using an honest budget are really severe and very long lasting,” Garrett said.

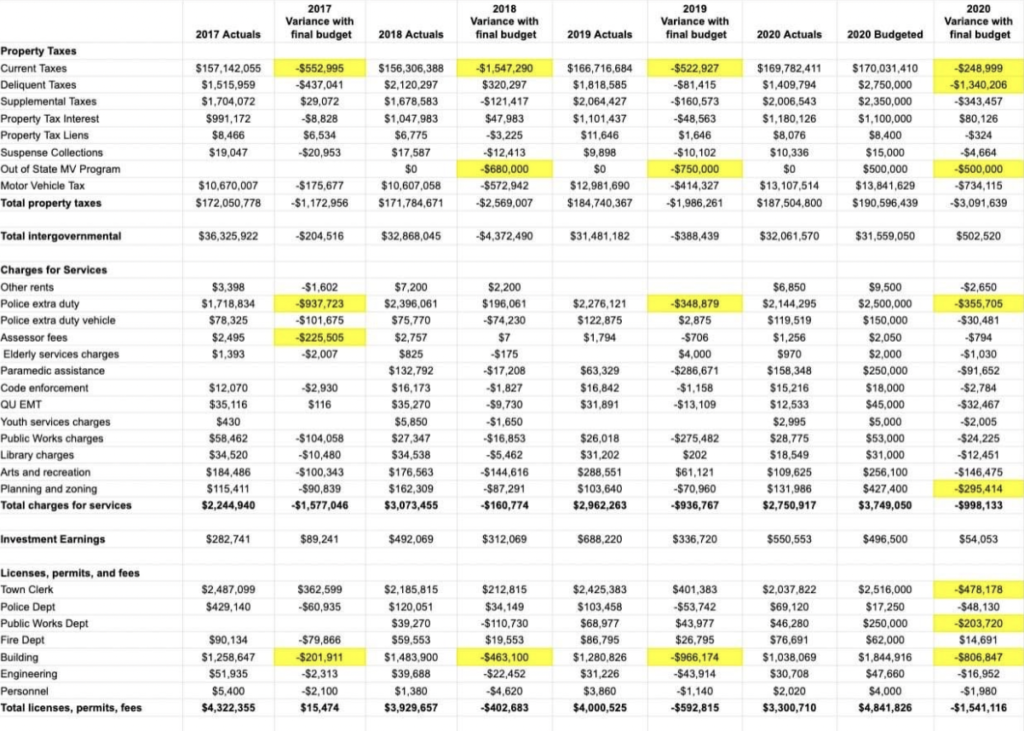

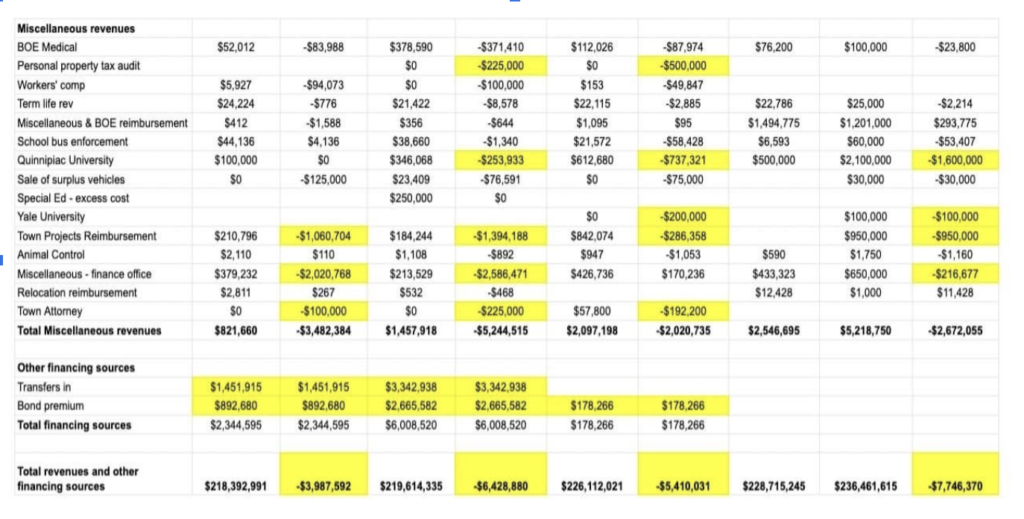

Garrett says that she spent a day writing this Facebook post. In it, she elaborates on the meaning of a “variance”, which is the difference between the amount budgeted by the council and the actual money that comes in for Hamden. For the past four years, that has been a negative number in the millions of dollars, with year 2020 totaling $7.6 million.

“The math makes it so that you have to have revenue from somewhere,” Garrett said.

This is where the town turns to borrowing money to cover the shortfall in revenue. According to Garrett, other members of the council say, since the interest rates for borrowing were low, money is super cheap and should be spent. But Garrett points out the opposite.

“That’s incredibly short-sighted when, considering that you have to pay it back, it’s no money. Money’s not cheap,” she said.

Since these conversations are not known by everyone, Garrett is trying to bring to light budgeting can be a dishonest deal. And why does that matter? Because a lot of that dishonesty comes from using people’s tax dollars.

“It’s really disingenuous because if you have to balance the budget by using borrowed money, at the end of the year, that’s costing the town more. It’s just that nobody’s going to see it for a few years… That expense is going to come due,” she said.

Garrett also wants the community to know that even though taxes and budgets keep rising, that is no indication that the financial situation in Hamden is rosy. In fact, it’s quite the opposite.

“Hamden is No. 1 in debt per capita,” she said. That statement is confirmed, too. “That’s something that I was talking about while I was on the council and it’s not going to get better unless we start seriously paying down our debt and stop trying to take on more debt.”

According to Garrett, the Municipal Accountability Review Board (MARB) decides what the Mill rate is for the town and what projects the town can work on. She believes the board will reduce the town’s bond rating.

“The council also said they were going to get $6 million from COVID, but they’re not….If every municipality got around $5 million from Congress, we’re talking thousands of trillions of dollars,” Garrett said.

While Garrett’s analysis of the budget is not optimistic, Michael McGarry, director of Hamden’s Town Council, said he sees the situation differently. He points to the history of how the town came to find itself in the current financial straits.

“I just think she could have provided a little more context,” McGarry said. “These problems weren’t created in the 2020 budget. They were created literally decades ago.”

He explained the council 10 to 12 years ago put the current council in a difficult situation that, he believes, is getting better.

“The financial outlook for the town five years down the line is pretty good,” he said. “We just have to change. We don’t have anyone new going into the pension. We have our seamers. pension funding, which we’re funding as we go. So, it’s better. And I think that should be acknowledged, too.”

On the other hand, an economist at Yale University, Christian McNamara, agrees with Garrett. He has a group that has been examining the town’s financial problems.

“When those overly optimistic revenue projections fail to fully materialize, the result has been annual operating deficits, reliance on borrowed money, and/or the underfunding of the pension,” McNamara said. “Moving forward, it is essential that Hamden adopt budgets that are based on realistic assessments of what we actually expect to achieve, informed by historical results.”