An incredible number of students at American colleges and universities take on student loans to complete their education. This is no different at Quinnipiac University, where 66 percent of undergraduate students have taken out loans.

The state of Connecticut has the highest average student loan debt in the U.S. at $38,510.

Unfortunately for the class of 2017 at Quinnipiac, they surpass that state average at $48,894.

According to Mark French, Director of Student Financial Aid at the Connecticut Office of Higher Education, this increase in student loans comes, in part, because of Connecticut’s fiscal problems. Over his 30 years working in financial aid and student loans, he says the state’s economic problems and the continuing increase in school tuition have forced students and families to turn to taking out more loans.

“Our financial aid budget has declined by almost 50 percent,” said French. “We were at about $60 million or so when I started and we’re down to about $32 million now in state grant aid that’s available. What do students do to make up that difference where years past on average twice as much of the award they’re getting today? Well, if schools can’t step up and provide the grant money, they’re turning to loans certainly.”

Christina Vittas, a junior advertising and integrated communications major at Quinnipiac fears how the stress of having tens of thousands of dollars owed will take a toll on her.

“My own personal loans scare me immensely,” said Vittas. “I know that I’m going to have the pressure of having to pay them back over my head for a very long time and I am worried what that stress will do to me over time.”

For many students, when they sign the dotted line for their loan, they aren’t thinking about paying them back just yet. Vittas, however, can’t stop thinking about the pressure these loans bring.

“To me it’s not about starting to think about paying back student loans, it’s how can I stop thinking about having to pay them back,” said Vittas. “Before I was even accepted to Quinnipiac my father estimated how much potential debt I could be getting myself in, and that made me so emotional.”

Vittas is aware of her debt after graduating, but the majority of students aren’t looking at the big picture. Associate vice president and university director of financial aid, Dominic Yoia, has seen this first-hand more times than he can count.

“How could anybody in their right mind at age 17 know that, ‘I’m going to borrow 20, 30, 40, 50, 60 thousand worth of loans and is this a good thing or a bad thing?’ because they’ve never done it before,” said Yoia. “I will tell you by the end they realize when we’re presenting all that information it all starts to sink in because payments are 6 months down the road, not 4 years and 6 months down the road when they first started doing this.”

Upon graduating, students will start having to pay back their loans. New graduates begin to struggle when they have to start paying back these loans on the salary of their entry-level job. Stephanie Cunha, who graduated from Quinnipiac in 2004 as a journalism major, had this exact experience.

Cunha is first generation born American to two Portuguese parents. She credits her drive and determination to go to college for her career and adult successes, even though her parents never counted on her going to college. Cunha worked hard from the time she was a teenager and took out student loans, along with receiving a scholarship, in order to attend Quinnipiac.

“I come from a pretty hard working background where I was working since I was 14 for pretty much everything that I ever needed, so clothes, computer for school, car insurance, you name it,” said Cunha. “It’s kind of been my reality from a financial standpoint that I always have to work my ass off, right? So when it came time for college I knew that I wanted to go to school because it was my own investment in myself.”

Cunha ended up graduating from Quinnipiac with $75,000 worth of student loans. Working her first job in broadcast journalism, Cunha struggled to make these payments.

“When you go into broadcast journalism and your first jobs are paying you $11 and $12 an hour and you take out that much in loans it definitely impacts you. I definitely lived at home for a lot longer than I wanted to,” said Cunha. “In a time period where you’re an independent person, fiercely independent, but you’re still going home to the same bed that you grew up in as a little kid, it did take a lot of an emotional toll.”

In order to have more stability and upward mobility in her job and be able to be more financially comfortable, Cunha made a career change.

“I took myself soul searching after my fifteenth quarter life crisis and just started to question, where was I going, was I in an industry that was expanding or was I in an industry that was contracting, and I realized that there wasn’t as much of a growing potential as I wanted in broadcast journalism, so I took the leap over to [public relations],” said Cunha.

Cunha admits the debt put both a financial and emotional strain on her, but after paying back those loans in 12 years, she now looks back at it as a necessary evil for her education, career, and future.

“It’s a necessary evil because you have to pay for [college] to get you the opportunities later on in life, so I just had to work on getting a balanced perspective on it, Cunha said. “It could feel pretty cumbersome at times, but I did have to work a lot harder in my 20s to have a balanced perspective.”

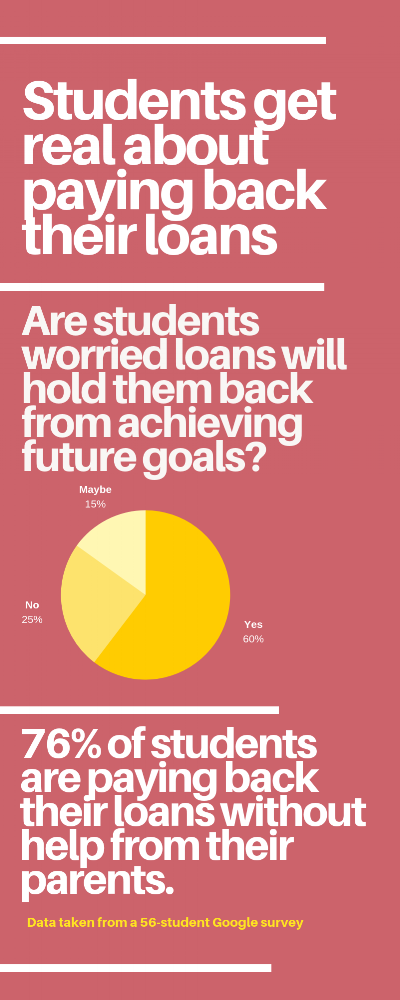

Many students worry how their debt can affect their future. Students have worries ranging from not being able to buy a house, to having to work a job they aren’t passionate about.

“I mostly fear that I will have to work multiple jobs and not be able to live my life to its full potential, or sacrifice my own happiness in order to not pour all of my income into paying back my student loans,” said Vittas. “At the end of the day I know I will be able to pay my loans back, but I worry that it will be much later than expected and I won’t be able to experience all that life has to offer at this young point in my life due to the pressure to pay off my loans.”

Students aren’t wrong in thinking their debt can hold them back. Andrew Guyton, a financial advisor and principal at The Guyton Group, has had clients who have had to put off certain milestones in life, like buying a house, getting married, and starting a family, because they are stuck in the debt of their student loan.

“You have to pay them back, otherwise you have all sorts of issues with your credit and things down the road,” Guyton said. “So look if your student loan balance is so high that you’re eating ramen noodles and beef jerky, and renting a 4-bedroom place that has 6 people living in it just so you can keep up with your student loan costs, then you’ve got an issue there.”

Cunha, like many other American students, broke the rule of thumb that is followed by experts in financial aid.

“The general rule of thumb we tell students is that if you take all of your student loan debt and add it up it should not exceed your first year’s salary fresh out of college,” said Yoia. “So if you happen to be a business major and you’re going to start at an accounting firm, let’s say you earn $55,000, you’ve got $35-$40,000 worth of loans, it sounds like a lot but, really, relative to the amount of income you have, it’s not.”

Fabio LoNero also hadn’t thought about paying back his student loans until he graduated from Quinnipiac in 2006.

“I knew that I’d hopefully get a job upon graduation where I’d be able to make the payments,” said LoNero. “The thought and planning really came into play upon graduation and after the deferment period was over. I also didn’t have the means to start paying down the loan while I was still in school.”

LoNero, a journalism major and currently an adjunct professor at Quinnipiac and a marketing and promotions producer, writer and editor at WTNH-TV in New Haven, graduated with $40,000 in debt from student loans that he is still paying off today.

“There was and still is a bit of stress because of the loans after graduating,” said LoNero. “You’re always wondering, especially fresh out of school, whether you’ll be able to make the monthly payments. Some of my interest rates were a little high as well, adding to the stress. The loans are still a source of stress for me as I’m still paying for them and will be for the foreseeable future. It’s a good chunk of change, almost like a small rent or mortgage payment that I could be putting to use elsewhere, such as saving or putting money aside to buy a house.”

After graduating LoNero had some personal setbacks that led to him paying back his loans slower than he would have liked. He advises that those in college now expect the unexpected and have back up plans if life gets in the way of paying back loans.

“It’s always nice to assume you’ll be able to pay more, or pay off the loan in a few years, but always be realistic and have that Plan B or C available so you have different scenarios as to what you’ll be able to do,” said LoNero. “Expect the unexpected. Life happens, and you can’t stop it. Job losses, emergencies, etc. And student loans are something you must pay back, no matter what, so you’ll have to take it all in stride. It can be a struggle, but I found it worth it to help get me through college, start and progress in my career.”

LoNero suspected he would be able to pay back his loans quickly, but many students today don’t make that same assumption.

And as college tuitions continue to rise, the loans students are applying for continues to increase. College tuitions have been skyrocketing and there is no ceiling in sight.

“When I first got here, quite honestly, the tuition and fees were much different,” Yoia said. “The tuition and fees to come here were $24,690. That was the tuition and fees, room and board in 1999. Fast forward now to 2018 its $62,500.”

As years passed, Yoia thought people would refuse to pay the steep price tag and turn to state schools for their education, but there hasn’t been a decrease in enrollment at Quinnipiac. Actually, there has been an increase.

“The numbers, the enrollment, the freshman class size has still been growing,” said Yoia.

At this point, Yoia says, he is unsure where the limit is for college and university tuition.

To combat costs, experts suggest other ways to save money and cut loan expenses.

“Working a little bit while you’re in school is helpful just to take the sting out of it a little bit,” Guyton said. “Making sure that when you pick your major and you’re taking out all this debt that it’s something that can sustain the debt on the tail end.”

“You can become an RA and get a room and board stipend, you can serve in student government, you can serve in several leadership positions on our campus that come with stipends as well as other colleges have similar opportunities, so let’s not just look to loans to cover your costs,” said Yoia. “I’ve got an outside scholarship book out front. See if you qualify for any of that. Here are some websites to go to. Here are things you can be doing. You can be working.”

Many students, like Vittas have done just that.

“I am currently an RA on campus so that significantly lowered the amount of loan money I was borrowing,” said Vittas. “Also by applying for as many scholarships as possible I could decrease the amount of debt I have.”

French said there is no easy fix to student loan problems, but he believes in a three-pronged solution that focuses on the student’s family, the government and the schools. Families need to better save and prepare for their child’s college expenses to to avoid having to borrow money down the road.

“Families need to do a much better job researching, understanding how much it’s going to cost for college, and knowing how much they need to save for college because every dollar a family can put aside while a child is young is potentially a dollar less they’ll have to borrow when that child’s in college, so families really don’t save the way they should,” he said. “They tend to look at other priorities in their lives and spend their money that way.”

Finally, French said, the government must allocate more money for student grants and financial aid. Schools need to slow, or cap, their tuition increases.

“It’s, for the most part, a political process. If legislatures at the federal and state level don’t hear from the students and families that the aid that’s provided is not sufficient, the legislatures definitely won’t do anything,” said French. “They need to hear constantly from families and students. Same with the schools. Although it’s not a political process per se, it still is that students and families need to be more vocal, I think, with their schools about controlling cost, controlling tuition increases and putting pressure there.”

No matter how big the student debt, though, there is always a light at the end of the tunnel. Cunha summed up her emotions upon paying off her student loans.

“The best day of your life is probably gonna be marriage, when a kid is born, and when you pay off your own student loans,” she said.